McCORDSVILLE — Town officials are expressing support for a nontraditional tax break a company wants in exchange for its help on a new road with economic development advantages.

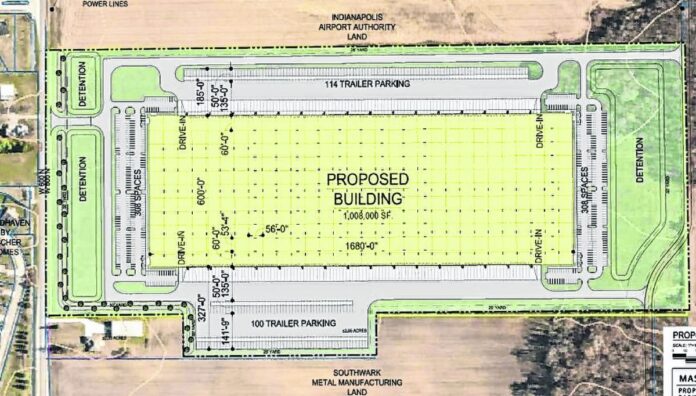

Cincinnati-based Al. Neyer is seeking the tax abatement for the 1-million-square-foot logistical/e-commerce building it wants to develop on 62 acres south of West County Road 600N east of Mt. Comfort Road. The development is speculative, meaning no occupants have yet been secured.

The land is currently part of unincorporated Hancock County and zoned industrial, which paves the way for such a building. But Al. Neyer is pursuing annexation into McCordsville and approval from the town for a real property tax abatement that’d be more financially beneficial than the kind of break the county typically grants. In exchange, the developer will help pay for part of Aurora Way, a planned road stemming east off Mt. Comfort Road and along the south side of the site. McCordsville leaders want the road for keeping large trucks off 600N, which runs to the south of the town’s Woodhaven neighborhood. Officials also want to see Aurora Way continue farther east in the future, providing an incentive for potential future industrial developments and annexations, building and diversifying the town’s tax base.

McCordsville Town Council voted 4-1 to pass a resolution earlier this week outlining a 10-year real property tax abatement for the development that would be 100% in its first year, 95% in years two and three, 90% in year four, 85% in year five, and 50% in year six before decreasing 10 percentage points over the following years until taxes would be fully phased in.

A public hearing on the abatement and second vote on the resolution is slated for the council’s August meeting, along with a final vote on the annexation. The council passed the annexation on first reading in June. Also that month, the town’s plan commission voted to give the property an industrial zoning designation if and when it’s annexed.

Council members Larry Longman, Barry Wood, Tom Strayer and Branden Williams voted in favor of the tax abatement resolution while Greg Brewer voted against. Brewer, who lives in the Woodhaven neighborhood and represents the many residents there who oppose Al. Neyer’s proposal, also voted against the annexation last month.

Wood voted against the annexation as well, but told the Daily Reporter he supports the tax abatement because of what it means for Aurora Way.

“Knowing that the annexation is going to go through anyway, I’m looking to get the best out of the rest of the process,” he said.

The tax abatement schedule differs from the traditional one governments throughout Hancock County often use, which typically starts 100% the first year and decreases by 10 percentage points each year over the years that follow.

Under the abatement Al. Neyer wants, the firm would save about $1.3 million more than if it had the traditional abatement schedule, according to an analysis by Baker Tilly, which provides accounting and consulting services to McCordsville.

The town already has plans to fund the approximately quarter-mile stretch of Aurora Way from Mt. Comfort Road along the southern border of a property where a Southwark Metal Manufacturing facility is under development. About 1,200 more feet will get the road to the abutting Al. Neyer site at an estimated cost of just over $1 million. Al. Neyer agrees to take on a third of that cost, putting the town’s responsibility, including a 15% contingency, at about $780,000.

The use of public funds for such a road construction project would typically require a bidding process.

“That doesn’t work with … Neyer needing to build out that part of the road while they’re doing their construction,” said Lisa Lee, a lawyer with Ice Miller who provides legal counsel to the town, at a town council meeting earlier this month.

Lee outlined exceptions to public bidding allowed in state law and recommended officials ask Al. Neyer to develop the stretch of Aurora Way and that the town reimburse its two-thirds up to $780,000. She helped Hancock County use the same method to fund improvements on West County Road 300N near Amazon’s fulfillment center.

“It’s a way to get the money in, it’s making them fund it upfront, making them fund it to your standards, and build it to your standards, and you don’t pay a dime until the road’s acceptable,” Lee said.

If Al. Neyer is open to McCordsville’s proposal, the town would still need to determine how it would reimburse its two-thirds of the road cost to the company. One possible solution could stem from making the Al. Neyer property a tax increment financing district or adding it to a nearby existing one. Baker Tilly’s analysis estimates the district would capture enough incremental taxes to cover the town’s cost for the road within several years, and accrue a total of about $5.5 million over the tax abatement’s 10-year period.

[sc:pullout-title pullout-title=”If you go” ][sc:pullout-text-begin]

WHAT: McCordsville Town Council meeting

WHEN: 7 p.m. Tuesday, Aug. 10

WHERE: McCordsville Town Hall, 6280 W. 800N, McCordsville

WHY: The council will hold a public hearing and vote on a tax abatement for a proposed 1-million-square-foot speculative building, and vote on an annexation for the property

[sc:pullout-text-end][sc:pullout-title pullout-title=”At a glance” ][sc:pullout-text-begin]

Proposed speculative development

- 1 million+ square feet

- South of West County Road 600N, east of Mt. Comfort Road

- $60.2 million

- Annexation into McCordsville proposed

- Developer: Cincinnati-based Al. Neyer

[sc:pullout-text-end]